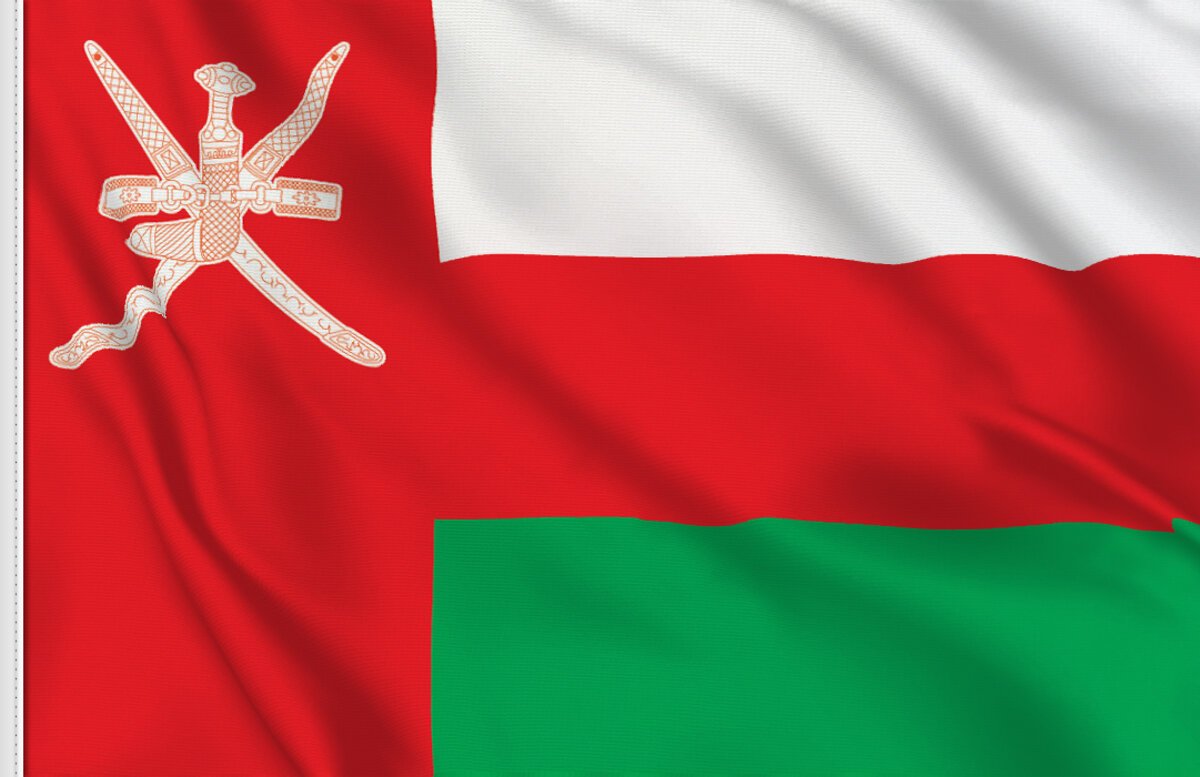

Event & ConferenceOman

The Embassy of Oman in the United States hosted a lavish reception to commemorate the 54th National Day.

Oman Horizon Bulletin

Oman’s 54th National Day was celebrated with a lavish reception organized by the Chargé d’Affaires of the Omani Embassy in Washington, D.C.

WASHINGTON: The event, which was hosted by the Chargé d’Affaires, brought together notable individuals such as the U.S. Deputy Assistant Secretary of State for Gulf Affairs, members of the academic and diplomatic communities, representatives from the U.S. government and Congress, and civil and military representatives. Omani nationals living in the United States were also welcomed at the occasion.

For all the latest news from Oman and GCC, follow us on Instagram, like us on Facebook & subscribe to our YouTube Channel, which is updated daily.